vermont department of taxes property valuation and review

MyVermontgov Account Not Logged In. State of Vermont - Online Directory Agency of Digital Services.

Vermont Department Of Taxes Youtube

Vermont Department of Taxes Division.

. Published by the Division of Property Valuation and Review Vermont Department of Taxes Phone. By Department of Taxes. VLCT News July-August 2020.

State of Vermont Department of taxes Division of property Valuation and Review 133 State Street Montpelier Vt 05633-1401. Taxes Department of 133 State St Montpelier VT 05633-1401. S0933-10 CnC the VAB Appeal the Town appealed from the Valuation Appeals Boards.

Search Any Address 2. About Abatement 2014 Handbook on Property Tax Appeals 2009 Additional Contacts Resources. The Vermont Department of Taxes Property Valuation and Review Division PVR will be implementing Axiomatics PropTax web application to manage.

Secretary of State Resources. State of Vermont Department of Taxes 133 State Street. Find property records tax records assets values and more.

Property assessments include two components-the. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of.

Ad Online access to property records of all states in the US. State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration wwwtaxvermontgov To. Propertys tax-exempt status or requiring the Property owner to pay the Town.

Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the propertys value of production of wood or. PVR Annual Report - Based on 2019 Grand List Data. PVR Annual Report - Based on 2018 Grand List Data.

See Property Records Tax Titles Owner Info More. A property tax is a levy on property that the owner is required to pay with rates set as a percentage of the home value. By Department of Taxes.

Honorable Shap Smith Speaker of.

Preferential Property Tax Programs In Connecticut And Vermont

New Look For Vermont Property Tax Bills Davis Hodgdon Cpas

2022 Business Alliance Partners Vermont League Of Cities And Towns

How An Education Fund Shortfall Could Impact Vermont Taxpayers

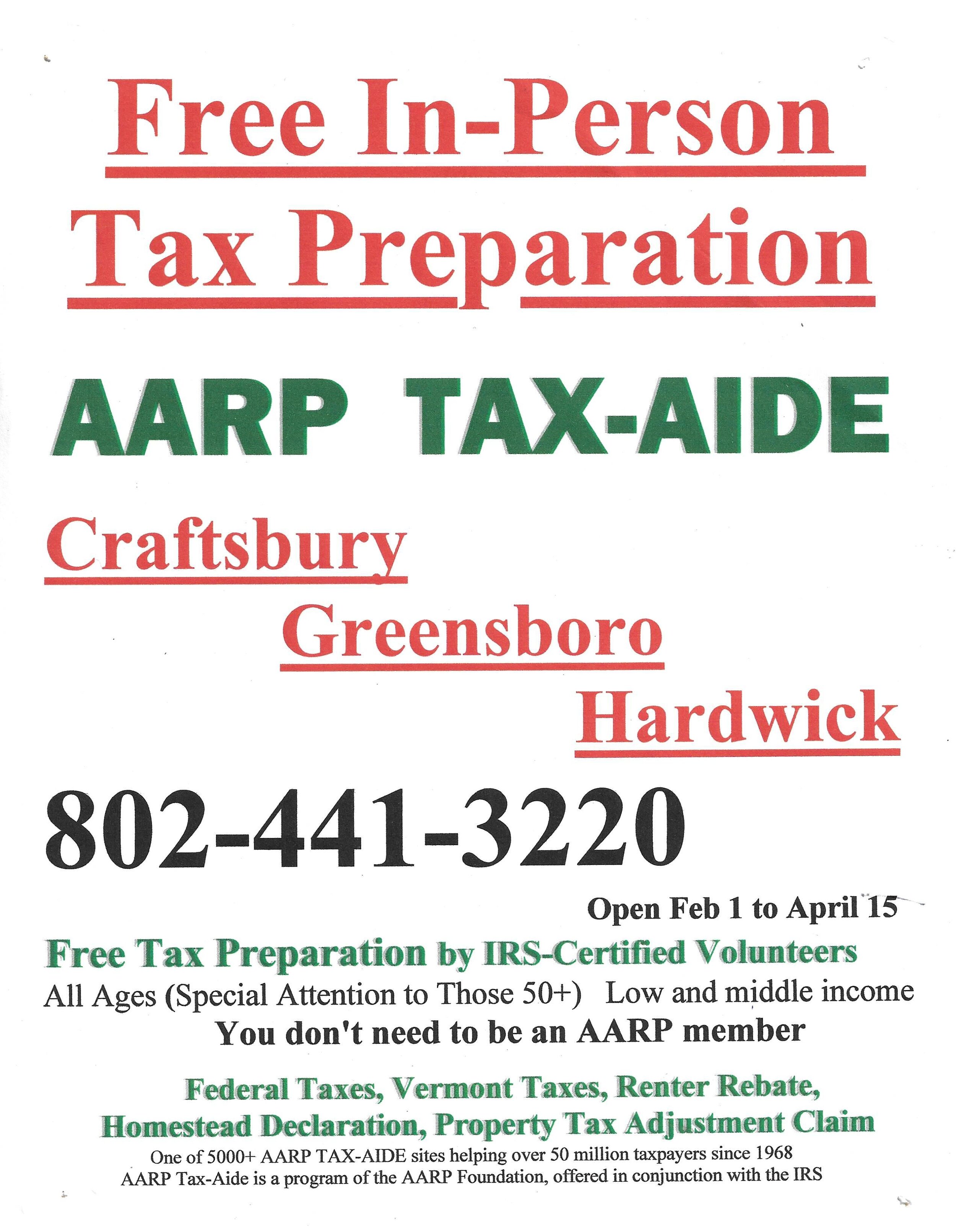

Vermont Tax Information Town Of Craftsbury

Fillable Online Tax Vermont Vt Form Property Valuation And Review Pvr Tax Vermont Gov Fax Email Print Pdffiller

Municipal Officials Department Of Taxes

Tax Burdened Residents Bear The Brunt Of Burlington S First Property Reassessment In 16 Years City Seven Days Vermont S Independent Voice

Williston Observer 1 20 2022 By Williston Observer Issuu

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

Municipal Officials Department Of Taxes

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Vermont Tax Information Town Of Craftsbury

Municipal Officials Department Of Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

Burlington S Property Reassessment Has Set Record High Values What S The Cost To Residents City Seven Days Vermont S Independent Voice