georgia property tax exemptions disabled

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. DeKalb County offers our disabled residents special property tax exemptions.

To apply for a disabled exemption you will need to bring your Georgia drivers license your Social Security Awards Letter and one Doctors Affidavit completed by your doctor.

. This is an exemption from all taxes in the school general and school bond tax categories. Other Personal Property Exemptions. If youre a disabled veteran youll qualify for up to a 60000 exemption.

A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating. Please contact our office directly here for personalized information. Applicants may also qualify for this exemption if 100 disabled regardless of age with a signed letter from your doctor stating you are unable to be gainfully employed.

Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter. Senate Bill SB-1073 introduced in April 2022 could provide partial property tax exemptions to disabled veterans with less than a 100 disability rating. The Disability Homestead Exemption excludes the ad valorem assessment for schools.

Complete Edit or Print Tax Forms Instantly. Currently there are two basic. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Complete Edit or Print Tax Forms Instantly. Ad Complete Tax Forms Online or Print Official Tax Documents. In order to qualify you must be 62 years of age on or before January 1 of the current tax year.

Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes. 8 rows People living in the house cannot have a total income of more than 30000. The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of property.

Georgia exempts a property owner from paying property tax on. GDVS personnel will assist veterans in obtaining the necessary documentation for. Items of personal property used in the home if not held for sale rental or other.

Reduce property taxes for yourself or others as a legitimate home business. The qualifying applicant receives a substantial reduction in property taxes. The only disabled property tax exemption in the state of Georgia is reserved for veterans.

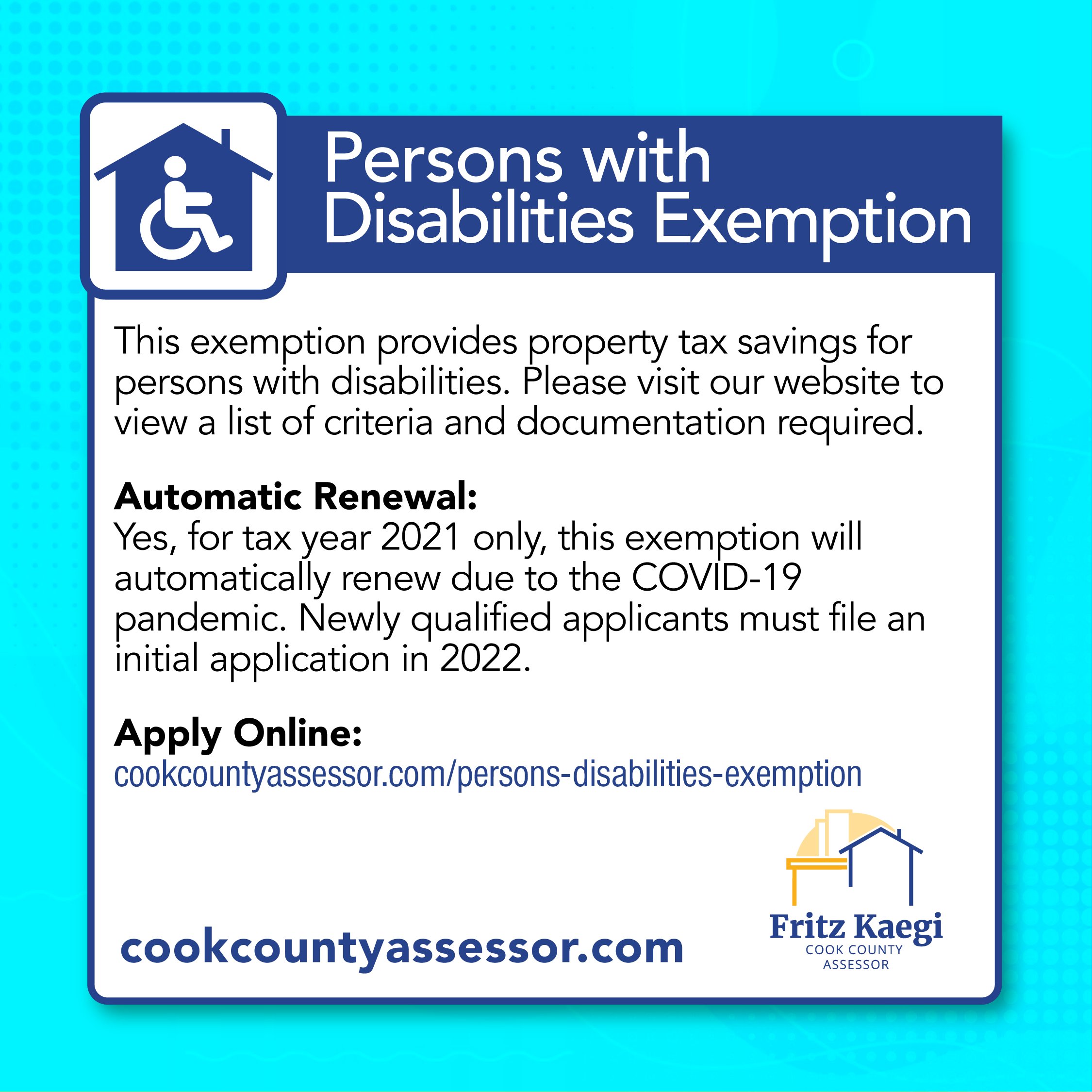

Ad Complete Tax Forms Online or Print Official Tax Documents. Senate Bill SB-1357 would extend a. Property tax exemptions are the partial reduction of a qualifying individuals tax burden.

S5 - 100896 From Assessed Value. Up to 25 cash back A disabled veteran or the unmarried surviving spouse of such a veteran qualifies for a substantial Georgia property tax exemption based a complex set of rules. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally.

So for example for a property with a Fair Market Value of 150000.

Property Tax Faq Newton County Tax Commissioner

Property Tax Faq Newton County Tax Commissioner

Chatham County Officials Say Residents Could Save Thousands Of Dollars On Property Taxes Wtgs

Exemptions To Property Taxes Pickens County Georgia Government

Respect The Flags Respect The Flag Safety Topics Bury

Are There Any States With No Property Tax In 2021 Free Investor Guide Retirement Money Property Tax Retirement Advice

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

What Is A Homestead Exemption And How Does It Work Lendingtree

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Property Tax Faq Newton County Tax Commissioner

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States